Propelled by the goal of decreasing payment cycle times, costs and increasing efficiencies, mandatory e-invoicing legislation is on the rise. E-invoicing is predicted to save the Australian economy AU$28 billion over the next decade (Source: ATO).

What is e-invoicing?

Electronic invoicing, known as e-invoicing, is the automated digital exchange of invoice information directly between a buyer’s and supplier’s accounting systems. With e-invoicing there is no longer a need for businesses to generate paper-based or PDF invoices that must be printed, posted or emailed. Buyers will no longer need to manually enter or scan these into their accounting system. It improves efficiency, reduces cost, and gets supplier invoices paid much faster.

How does e-Invoicing work?

What makes e-invoicing possible is the safe and secure international Peppol network that allows invoice data to be exchanged between different software or systems. To start e-invoicing, your software needs to be connected to the Peppol network. Many small business accounting software providers already offer Peppol e-invoicing options, like Xero we recommend and use.

It doesn’t matter which software you and your business partners use to invoice though, as long as you’re both connected to the Peppol network. For example, e-invoices can be exchanged between Xero and non-Xero software.

Benefits of e-Invoicing

- Greater accuracy – A direct exchange between accounting software means less manual handling for incoming e-invoices, reducing the risk of errors.

- More efficient – e-invoicing takes the admin out of invoicing and paying bills by removing the need to email PDFs invoices or links.

- No more lost invoices – save time by getting the right information to the right contact on time

- Safe & Secure – e-invoices are exchanged through a secure e-invoicing network with no human intervention, reducing the risk of interception and fraud.

- Faster payments

- Better business decisions, based on correct, real-time financial information.

Can e-invoices be sent to anyone?

e-Invoices can only be sent to a business or government department, as long as they are registered to receive e-invoices. Both the sender and receiver need to be using accounting software that is connected to the Peppol network.

You can confirm that your customer is registered to receive e-invoices through their accounting software using the Peppol directory.

Initially, business will only be able to send an e-invoice to another business or government department in the same country. Xero is working on extending this capability to support international trade in due course, where markets are covered by the Peppol network.

How do I get started?

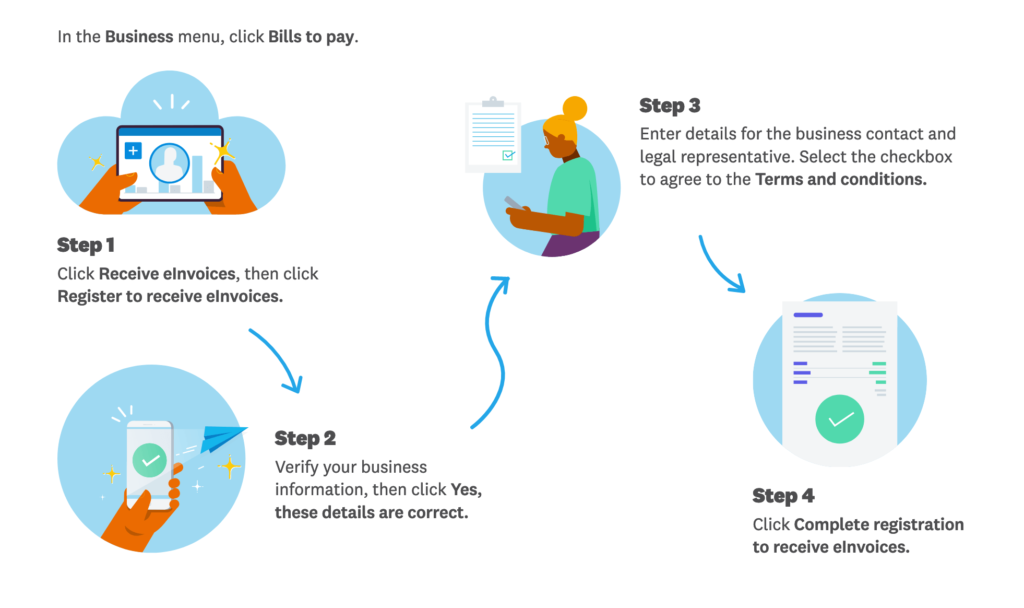

Register your business to receive e-invoices in your accounting software. If using Xero, follow the steps shown below:

Once you have successfully registered, all of your incoming e-invoices will sit as a draft bill ready to be approved and paid.

How do I send and receive e-Invoices?

Here’s a little overview video from Xero to help you get started:

A seamless experience in Xero

Xero has been investing in e-invoicing for a number of years, as part of our focus on digitising small businesses to help them become more efficient and get paid faster. As a result of e-invoicing, many businesses will want to switch to cloud-based accounting platforms, as it’s much easier to manage e-invoicing in the cloud than using software installed on a server. In Xero, it’s as simple as clicking a toggle switch when invoicing a customer. Xero has also made sure there’s a strong audit trail in our e-invoicing solution, so you can see where the e-invoice has been sent and when. Best of all, e-invoicing will be included free of charge for Xero customers on starter, standard and premium plans.

If you have any questions about the above or would need help setting up e-invoicing, please contact us today.